2026

10

January

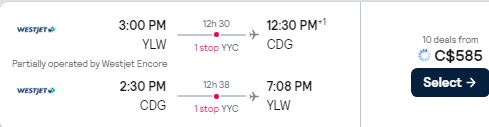

Kelowna to Paris, France - $585 CAD roundtrip including taxes [Off-Season]

10

January

WestJet has dropped the price of their off-season flights from Kelowna to Paris, France down to $585 CAD roundtrip including taxes.

The flights have 1 stop in Calgary each way.

You can also find flights from larger hub cities like Paris to warmer places in Southern Europe and the Mediterranean for under ~$150 CAD roundtrip.

NOTE: WestJet's UltraBasic fares to Europe and Asia still include carry-on.

Availability for travel

January, February, early March 2026

How to find and book this deal

1. Start with the following Google Flights search:

Google Flights: Kelowna to Paris, France

- Click on the departure date box to open up the calendar view.

- Browse for the cheapest dates by adjusting the trip length at the bottom.

- Look for the dates that are $627 roundtrip

2. Go to Skyscanner or Kayak

3. Search for a flight from Kelowna (YLW) to Paris, France (CDG)

- Try the same dates you found on Google Flights.

You can find flights from larger hub cities like Paris to warmer places in Southern Europe and the Mediterranean for under ~$150 CAD roundtrip

1. Try this Google Flights search to places in Southern Europe and along the Mediterranean for under $150 CAD roundtrip.

Can't find this deal anymore? Prices change as deals sell out. The key is to be among the first to know when an amazing deal is posted.

Click here for tips on how to never miss a deal again.

screenshot from Skyscanner

Sign up for YLW Deals Alerts from Kelowna

Go to the Alerts Page to sign up for flight deal alerts by e-mail, Facebook, or Twitter.

Travellers from Kelowna also often sign up for alerts from Vancouver and Calgary.

Live deal discussion & travel advice

For live discussion of this deal, or to get some amazing travel advice (to anywhere) from your 6,000 fellow passengers in Kelowna, join us

in the YLW Deals Facebook Group

^^^ click the 'Join Group' button when you arrive.

Hit Like if you like this deal! Click Share to show your friends on Facebook.

2025

26

December

Kelowna to Halifax, Nova Scotia - $291 [CB] to $426 CAD roundtrip including taxes

26

December

2025

20

September

Kelowna to Tokyo, Japan - $637 to $737 CAD roundtrip including taxes

20

September

2025

2

August

Kelowna to Seoul, South Korea - $718 to $866 CAD roundtrip including taxes

2

August

2025

28

July

Kelowna to Rome, Italy - $512 CAD roundtrip including taxes [New Record!]

28

July

2025

28

July

Kelowna to Bali, Indonesia, Malayasia, or Thailand - $853 to $953 roundtrip including taxes [Cathay Pacific]

28

July

2025

8

July

Kelowna to Singapore - $834 to $934 CAD roundtrip including taxes

8

July

2025

23

June

Kelowna to Dublin, Ireland - $504 to $604 CAD roundtrip including taxes

23

June

2025

2

June

Kelowna to Reykjavik, Iceland - $490 to $657 CAD roundtrip including taxes

2

June

2025

20

May

Here's a spreadsheet of every nonstop ('direct') flight from Kelowna to somewhere with a beach, sorted by the number of hours to fly there

20

May